Realty Cash Flow Investments: A Overview to Building Riches

Real estate capital financial investments have long been a tested approach for building long-lasting wide range and creating passive earnings. By concentrating on residential properties that provide positive cash flow-- where rental revenue goes beyond expenses-- financiers can produce a secure revenue stream while taking advantage of property gratitude with time. Whether you're a experienced investor or just starting, recognizing the principles of capital realty financial investments is key to maximizing returns.

In this short article, we'll check out the benefits of cash flow investments, the types of homes to think about, exactly how to examine prospective offers, and suggestions for managing and growing your real estate portfolio.

What Is Cash Flow in Property?

Capital in real estate refers to the take-home pay created from a building besides business expenses and mortgage settlements have actually been covered. Basically, it's the revenue left over from rental income as soon as all expenses are deducted. Positive cash flow occurs when the rental earnings exceeds the property's costs, creating profit for the financier. Alternatively, negative cash flow occurs when expenses surpass the rental earnings, resulting in a economic loss.

The Advantages of Cash Flow Property Investments

1. Steady Passive Earnings

One of the key benefits of capital realty investments is the constant stream of passive revenue they offer. When you buy a money flow-positive home, lessees' lease repayments cover all expenditures ( consisting of the mortgage), and the excess comes to be income. This revenue can supplement your day job, fund various other investments, or be reinvested right into your real estate profile.

2. Appreciation With Time

In addition to capital, real estate financial investments generally appreciate over time. While capital offers prompt financial advantages, admiration enhances your building's value over the long-term, developing prospective for substantial capital gains. This combination of month-to-month capital and long-term recognition materializes estate a powerful wealth-building tool.

3. Tax Benefits

Investor benefit from a variety of tax advantages, which can better improve cash flow. Devaluation reductions, for instance, allow you to minimize your taxable income by writing off the perceived damage on the residential property, although the asset is most likely valuing in worth. Furthermore, costs associated with residential property monitoring, repairs, and home loan passion can be subtracted from your earnings, decreasing your general tax obligation.

4. Hedge Against Rising cost of living

Property tends to be a solid bush versus rising cost of living. As the price of living increases, so do rent costs, enabling capitalists to enhance their rental earnings with time. On the other hand, set mortgage payments continue to be the very same, improving cash flow as rising cost of living rises. Property's capability to keep pace with inflation assists protect your financial investment and make sure lasting success.

5. Utilize and Equity Structure

One of the unique elements of realty is the ability to leverage your investments. By using financing (such as a home loan), you can control a valuable possession with relatively little funding upfront. As lessees pay for your mortgage, you construct equity in the residential or commercial property. Gradually, this equity can be used to secure added funding for new investments, even more increasing your profile and cash flow potential.

Types of Cash Flow Real Estate Investments

1. Single-Family Houses

Single-family homes are one of one of the most preferred sorts of property investments, especially for those new to spending. These residential properties are relatively very easy to finance and handle, and they appeal to a broad variety of tenants, from young families to specialists. While single-family homes might not create as much cash flow as multi-family buildings, they can still offer strong, consistent returns.

2. Multi-Family Properties

Multi-family properties, such as duplexes, triplexes, or apartment buildings, are outstanding for producing greater cash flow. With multiple rentals, you can spread risk across several lessees, lowering the influence of jobs. Multi-family homes usually supply greater returns than single-family homes yet call for even more capital and administration initiative.

3. Industrial Property

Business realty (office buildings, retail spaces, and storage facilities) can be a profitable option for cash flow capitalists. Industrial leases are usually longer than domestic ones, supplying a more stable income stream. Nonetheless, purchasing industrial realty requires a much Real estate cash flow investments deeper understanding of market patterns, tenant demands, and zoning legislations.

4. Short-Term Rentals

Short-term rental residential or commercial properties, such as villa or Airbnb leasings, can create considerable cash flow, especially in high-demand vacationer areas. These residential or commercial properties frequently regulate higher nighttime prices than long-lasting services, however they also feature greater administration costs and the danger of seasonality. Financiers should thoroughly evaluate the advantages and disadvantages of short-term leasings to identify if they straighten with their economic goals.

Exactly How to Assess Capital Property Investments

1. Cash-on-Cash Return

Cash-on-cash return is a statistics that determines the annual return on your cash money investment, taking into consideration the income generated about the first cash money invested. To calculate cash-on-cash return, split your annual cash flow by the overall amount of cash money spent. As an example, if you invested $50,000 in a property and earned $5,000 in cash flow each year, your cash-on-cash return would certainly be 10%. A higher percentage indicates a extra successful financial investment.

2. Cap Price

The capitalization price (or cap price) is another beneficial metric for evaluating capital buildings. It represents the home's annual net operating income ( BRAIN) split by its acquisition cost. For example, if a home produces $50,000 in yearly NOI and the acquisition cost is $500,000, the cap rate would certainly be 10%. A greater cap rate recommends better cash flow potential, though it might likewise reflect greater risk.

3. Rent-to-Value Proportion

The rent-to-value (RTV) proportion contrasts a residential property's monthly rental revenue to its purchase cost. A usual rule of thumb is the 1% rule, which states that a building must create regular monthly rental fee equal to a minimum of 1% of its acquisition rate. For instance, if a property costs $200,000, it must generate at least $2,000 in regular monthly rent. While not a definitive statistics, the RTV proportion can help investors rapidly examine whether a residential property is likely to generate positive cash flow.

4. Financial Debt Service Protection Ratio (DSCR).

The DSCR determines the residential or commercial property's capability to cover its home loan repayments. It's determined by dividing the residential property's internet operating earnings by its overall financial debt service ( yearly home loan repayments). A DSCR over 1 indicates https://greenspringscapitalgroup.com/ that the building creates adequate revenue to cover the home loan, while a DSCR below 1 suggests the residential or commercial property might battle to pay.

Tips for Optimizing Real Estate Cash Flow.

1. Purchase Below Market Price.

Among the most effective means to make the most of capital is to get homes below market value. Seek distressed properties, foreclosures, or off-market bargains where you can discuss a reduced price. Buying at a price cut not only raises your instant capital but likewise gives a cushion in case of unforeseen expenditures.

2. Minimize Job Fees.

Vacancies are just one of the biggest dangers to capital. To minimize jobs, target homes in high-demand areas, display lessees carefully, and preserve excellent connections with your occupants. Providing affordable lease prices and keeping the residential or commercial property in exceptional condition can assist keep vacancy rates low.

3. Improve Property Management.

Efficient building management is important for preserving and growing cash flow. Whether you choose to manage the property yourself or employ a specialist administration business, guarantee that rent is accumulated in a timely manner, maintenance issues are addressed promptly, and tenants are completely satisfied. Delighted renters are most likely to renew their leases, reducing turn over costs.

4. Consider Value-Add Strategies.

Value-add strategies, such as renovating systems, updating facilities, or boosting visual allure, can boost rental income and residential or commercial property worth. While these enhancements require in advance capital, they can cause higher rental fees and much better capital in the long run.

Property cash flow investments provide a effective possibility for investors to construct riches and produce easy revenue. By focusing on buildings that create positive capital, evaluating potential offers carefully, and executing methods to maximize returns, you can produce a trustworthy revenue stream that expands with time. Whether you're purchasing single-family homes, multi-family residential or commercial properties, or industrial real estate, capital investing can aid you accomplish monetary self-reliance and long-lasting riches production.

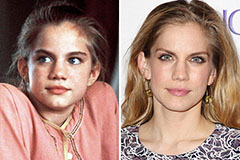

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!